Part 2 of our UK Housing Crisis looking at “Generation Rent” – whether it is a forced situation or a choice? We explore the benefits and drawbacks along with the necessitated resolutions.

You can read Part 1 of this article here that discusses the genesis of the UK housing crisis.

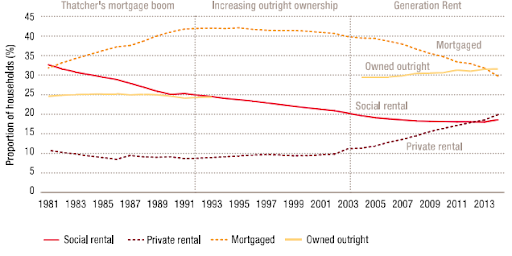

From its humble beginnings in 2003 to its peak in 2015, amidst tightening credit conditions, sparse housing supply, restrained government interventions, stagnancy in wages earned, and the looming guillotine personified by Brexit – the proportion of households rented privately effectively doubled.

Fourth Stage – Generation Rent

The most accurate description of generation rent is given by James Moore (2018), the chief business commentator at Independent:

40 percent of Brits are renting privately at the age of thirty, double the rate for Gen X and 4x that of baby boomers.

Due to the build-up of a housing need that is not properly regulated, the rental market has gradually fallen into the hands of the landlord.

The status of inequality, existing between the private renters and the property owners, has reached astronomical heights where a pensioner paying the mortgage would need to pay only 19% of his/her income in comparison to 50% of the income of a private renter being diverted towards rent (Pettinger, 2016).

Experts believe that if this scourge of unaffordable living is not remediated, the problem will escalate to eventually yield failing communities all around the UK (Edge, 2018).

It has already started to impact the physiological well-being of millions of Millennials, leading to depression, anxiety, and suicidal tendencies.

Startling evidence was unveiled at a recent campaign, organised by a non-profit called Mind, indicating that “nearly 79% of the people with mental health disorders regard their housing situation to be a primary trigger and retention factor of their illness” (Cosslett, 2018).

The UK Housing Supply

As we strive to find solutions, it is painfully obvious that history is repeating itself.

Nevertheless, the mortgage boom did not just bring us back where we started but initiated the exacerbation of the housing situation to such a degree that hopelessness has become a common feature of the British youth when it comes to housing stability.

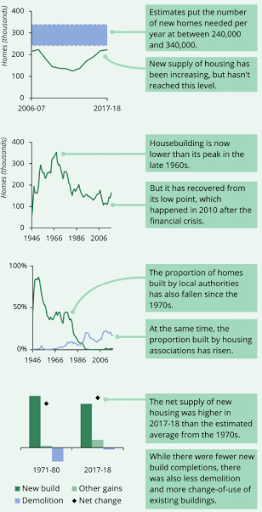

Research indicates that around 300,000 homes have to be constructed each year to adequately meet the demands of the behemoth known as the United Kingdom (Arthur, 2018).

In 2014, however, due to the construction of only 112,370 houses, the price of an average house is now equal to eight times the average annual earnings of a British citizen (Arthur, 2018).

Built to rent vs Social housing

Stuck in an overpriced housing environment, the extremely stressed out under 35 segment of our British population further stratified themselves into two sections, each supporting a different ideology and claiming that it is they who have the magic antidote.

The first major solution being proposed was that of Social Housing whereby home associations rent out their properties below the market rate. The option ticked all of the necessary boxes and the government has recently funded the local council with an amount surmounting to £866 million.

However, opposition dictates that such a mechanism would only help in transitioning our youth from being generation rent to become generation dependant. It was argued that the government would be providing too much ease for a cohort that needs to become financially independent to institute well connected and functional communities in the future.

This is where the second segment comes into play, introducing Built to Rent housing schemes and claiming that the future bearers of economic burden would be sufficient enough to fund themselves and live a life full of convenience if the strategy is optimally adopted.

The Built To Rent movement also has the upper hand over Social Housing Programs, in the sense that it typical adheres to the typical millennial mindset by ensuring the availability of suitable “environments, conveniences, and amenities” in correlation with properties (Arthur, 2018, par. 9).

This too has garnered much attention as many believe that the Buy to Rent mechanism harbours great prospect for uplifting the UK’s economy. Even though a lot of alternate sources have contributed considerably to backing up this methodology in order to exploit its benefits, the stratagem has not proven itself to be capable enough, as of yet, to overcome the restrictions placed by political instability and through it – a depreciation of sustainable investments.

Still, this time around, the same disheartened youth had been blessed with tools, techniques, and contrivances never conceived before in the 4.5-billion-year-old history of our planet.

Fifth Stage – Liquid and Interoperable Properties

The notion of contrivances beckons us to the Fifth Stage of the UK housing dilemma – the age of PropTech, ConTech, InsurTech, and Sharing Economies. If amalgamated and systemised to be seamlessly interoperable, these disciplines in unison may represent the most significant facet of the fourth industrial revolution.

The destiny of the millennials is not to remain under the servitude of the previous generation nor is it to blame them for all their problems – that is unnecessarily counterproductive. The only hope is to utilise technology and innovation to discover the power of community-based endeavours that invest in social capital through cutting edge technological innovations.

Capitalising on the intent and preference of millennials to be long term renters rather than first-time buyers, an arsenal of start-ups have sprung up to catalyse the incidence of innovative businesses (Donnelly, 2018). Let us explore some of the brightest minds in action who are attempting to empower you to rise above your inherent limitations to conquer the spheres of Property and Prosperity.

Urban Jungle

A London based PropTech start-up employs machine learning to assess risks associated with UK properties so that its millennial users can choose the best available option within the home insurance market.

Movebubble

Talk to agents and schedule property viewings in just two clicks while browsing a catalogue comprising more than 25,000 properties – all from the comfort of your sofa

Ideal Flatmate

A housemate searching platform that identifies suitable living partners based upon compatibility ratings of the users, derived beforehand through a survey enlisting only 20 questions.

Rental Step

Provides a similar service as Ideal Flatmate but to enhance collaboration amongst landlords and tenants, providing detailed reports to help both parties in making informed decisions

Zisk Properties

If we as a nation have truly conquered over our housing crisis in a state of war, then we at Zisk formally announce that we have planned an evidence-based confrontation against every single deterrent there is to the financial freedom – regardless of the generation they belong to. We are attempting to change the very nature of homeownership; whereby long-term renters can choose to be first-time buyers simultaneously.

Presently, we offer properties with a low barrier for entry, cherry-picked by our veteran panel of Property Experts (while our PropTech and FinTech genuises work behind the scenes to make it all happen). With investments starting from as little as £100 going to an infinite amount and beyond, you can start benefiting from the crisis rather than choosing to be trampled by it.

So join us in exploring the unlimited potential of truly smart cities and be an early adopter of a service that will completely revolutionise the perception of property and the deficiency of liquidity within it – forever.

Link to Part 1: The UK Housing Crisis – Part 1: EU & The British Residential Saga

References

Arthur, M. T. (2018). Social housing or build to rent: What is a better solution for generation rent? Retrieved from https://www.propertyreporter.co.uk/landlords/social-housing-or-build-to-rent-what-is-a-better-solution-for-generation-ren.html

BBC. (2018). Young people with deposits still cannot buy homes. Retrieved from https://www.bbc.com/news/business-45776289

Cosslett, R. L. (2018). ‘I have sleepless nights’: the looming mental health crisis facing generation rent. Retrieved from https://www.theguardian.com/society/2018/may/09/mental-health-crisis-generation-rent-millennials-own-home-wellbeing

Donnelly, S. (2018). Business Ideas for 2018: Generation rent solutions. Retrieved from https://startups.co.uk/business-ideas-2018-generation-rent/

Edge, S. (2018). Generation Rent & the Problem of Community. Retrieved from https://www.steve-edge.com/outer-thinking-division/generation-rent-problem-community/

Moore, J. (2018). Millions of millennials will never own homes so it’s time to make renting work better. Retrieved from https://www.independent.co.uk/news/business/comment/generation-rent-millennials-home-ownership-house-prices-resolution-foundation-a8308396.html

Pettinger, T. (2016). A consequence of generation rent. Retrieved from https://www.economicshelp.org/blog/15804/housing/consequences-of-generation-rent/

PwC. (2015). UK housing market outlook: the continuing rise of Generation Rent. Retrieved from https://www.pwc.co.uk/assets/pdf/ukeo-section3-housing-market-july-2015.pdfUK Parliament. (2018). Tackling the under-supply of housing in England. Retrieved from http://researchbriefings.files.parliament.uk/documents/CBP-7671/CBP-7671.pdf