Coronavirus has impacted not only our lives but also the UK Property Market in 2020. And the impacts are here to stay! But is now a good time to invest in UK properties? We believe UK property investment in 2020 can still be a great idea and here’s why!

It has been months now since we are all affected by the Coronavirus in some shape or form, even if just observing a lockdown (self-inflicted or enforced by the government). Of course, there are those who are far severely affected – men and women who need to be on the frontlines during these testing times or worse, they were or a loved one was infected by the virus. Our hearts go out to those affected severely with best wishes for them, their families and loved ones.

I would also like to take this opportunity to thank all those who have been working on the frontlines, including doctors and nurses, any kind of delivery or postal workers enabling us to receive post, groceries and other essentials from the comfort of our homes while they face higher risks.

Coming to the topic – UK Property Investment in 2020 and Coronavirus, there are many questions. When will Covid19 end? Is UK Property Investment in 2020 still a good idea? How can I achieve best property rental yields or buy into a high return investment in these market conditions? Shall I invest in UK properties now or wait? Here are my views!

SO FAR, THERE IS LIMITED IMPACT ON HOUSE PRICES AND RENTAL YIELDS

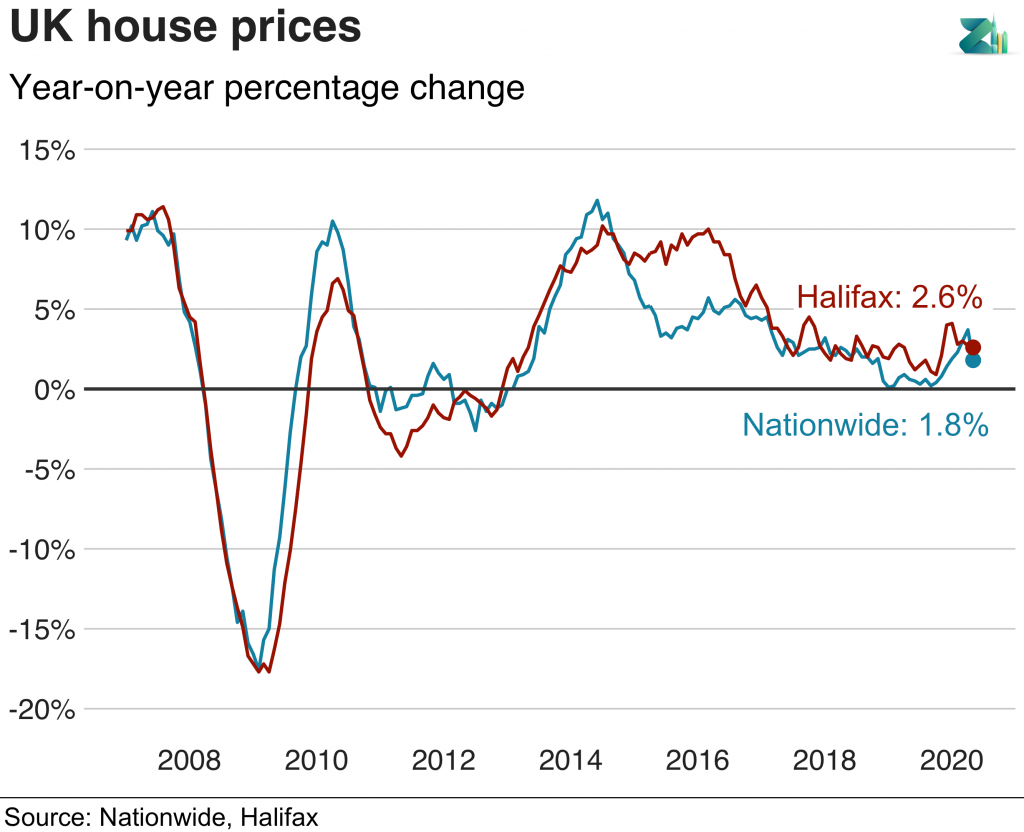

I wonder should if the limited impact on UK property despite the severity of the global impact of the Covid-19 (infections, deaths, lockdowns, recessions) should come as surprising or be expected given the UK Property Market has times and again proven its resilience. In May 2020, according to Nationwide’s house price index, prices fell around 1.7% compared to April.

Part of the reason for this limited impact I believe is the UK Government deciding to put the economy on pause – or as far as it could e.g. through the lockdown, restrictions on transactions, launching the furlough and grant schemes, different business loans, etc. And I believe that’s a good thing, not only for the property market but the wider economy and people to be able to cope with the pandemic.

But another key reason for this limited impact is the resilience of the UK Property Market – which, in turn, can be attributed to various factors. Some of these include:

- Overseas investments pouring into London Property, due to it being considered a safe-haven

- London being a strong, strategically placed financial hub – which I believe will continue even post completion of the Brexit

- Us Brits have a sentimental attachment to our Bricks & Mortar Investments. And there is an element of fascination with the Buy-to-let market as well

- We live on an Island meaning land is finite, restricting the property supply. With increasing population and demand, property prices will have an upward demand driven pressure

- And we already have a housing shortage in the UK, further increasing demand. The housing shortage is due to various many reasons – please refer to our Housing Crisis Series here for more details (Part 1 and Part 2).

This resilience can be proven if we look back at the 2008 credit crunch, the worse financial crisis we have seen in our lifetime. The impact of which on the UK Property Market was a hit of around 20% to 30% on property prices. But the market recovered within 1-2 years in most UK regions, including London. That’s absolutely insane, in a good way for us property investors.

BUT I WANT TO KNOW WHETHER I SHOULD INVEST IN UK PROPERTY NOW?!

I believe the landscape for the Property Market in the UK will change due to Covid19, and is likely here to stay. Example the retail industry, that was already facing challenges, will be further adversely affected. In some cases, offices and commercial property might also be affected – especially with some businesses realising working from home is now a reality with technology as the enabler, which can mean reduced cost without compromising efficiency or delivery, if you have the right mindset and the right tools. So some businesses may consider offering more work from home flexibilities, if not completely moving to work from home models (at least certain industries or departments). Startups and small businesses have been doing this for a while now, to begin with!

This only means property demand in certain sectors may reduce, but will potentially be replaced by an alternative demand. As a result, property investors should consider diversifying (which is always a good idea anyway), and consider investing in properties that are likely to be attractive in the Post-COVID19 world.

Examples include:

- Residential properties in the suburbs and towns, that allow working from home but still has good access into cities for those meetings or events, may end up being in higher demand with a focus on social distancing.

- New-build developments and flats that re-think, at a design level, on how to allow for such safety measures; installation of purifiers, larger or more lifts, wider stair cases, spacious communal areas and maybe even direct access to flats from the outside.

So both, real estate investing and real estate construction needs to be smarter.

Having said that, the major UK Property Research Hubs are forecasting a 5% to 10% fall in house prices over 2020 which is impressively low in my opinion given the scale of the pandemic. Not only that, the forecasts include a full rebound by the end of 2021 in most cases.

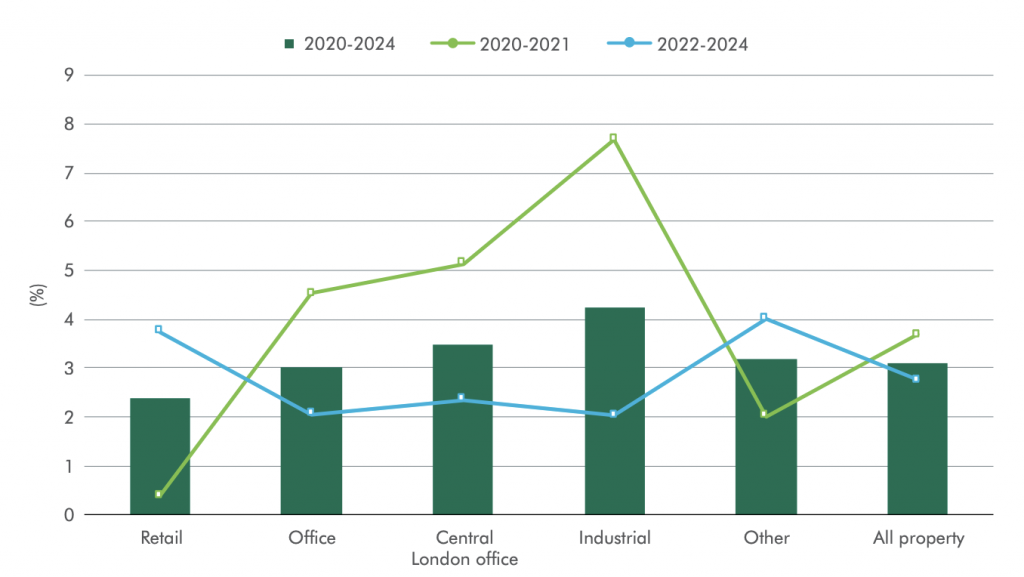

CBRE expects a total return of 3.1% pa until 2024 with a 3.7% pa forecast for 2020 to 2021.

Source: MSCI, CBRE Research “Real Estate Market Outlook 2020, United Kingdom”

CBRE provides a modest forecast of total returns of 3.1% per year from 2020 to 2024. This includes capital growth as well as rental returns. It is worth highlighting that these forecasts take into account a rental yield of only 4.4% pa – we consider this a low return based on our experience. In fact, these are rental yields for London – locations with relatively high property prices end up being the culprit. But in exchange for this compromise, locations like London do offer higher “perceived” security.

So investing in a buy to let in London is always worth considering from a security perspective. In fact, one of my clients, an overseas investment bank, is only interested in investing in London rental properties that generate a high ongoing income – with a focus on keeping their capital as safe as possible. If enough people believe London property is a safe-haven, then it actually becomes one – which is what has happened so far.

Overall, the property market has two things going for it even in these rapidly changing times.

Jonty Bloom, BBC Business Reporter in a BBC article

The first is that even if the price of property falls, it may still be a wise investment. This may sound perverse, but property is a long-term investment, and not many others are both secure and pay a good return.

So if government bonds are paying 0.5% interest a year, or even less, and property is making 3-5%, you still have a good source of income if you are a private investor or global investment fund.

Savills forecasts two scenarios – both suggest a total return of 15% over the next five years.

Savills forecasts two scenarios in light of the current uncertainty. With the lockdown measures reducing this month, if things continue to improve with the Coronavirus (infection and mortality rates, economic and business impact), then Scenario 1 where prices drop by 5% but next year fully rebound.

If things worsen, then a 10% prices dip but by 2022, the rebound being sufficient to make an overall profit of 6% for investors by then.

| 2020 | 2021 | 2022 | 2023 | 2024 | Cumulative | |

|---|---|---|---|---|---|---|

| 2019 forecast | 1% | 4.5% | 3% | 3% | 3% | +15.3% |

| Scenario one | -5% | 5% | 8% | 4% | 4% | +15.4% |

| Scenario two | -10% | 4% | 12% | 6.5% | 3% | +15.0% |

But the total returns can be easily over 50% over the next five years.

The above Savills figures only reflect the impact of Coronavirus on UK house prices – and so ignores any rental returns.

Rental income from a property is often ignored when I look at different price analysis or growth forecasts. I believe part of the reason is the very different methodologies and the different data collection agencies for both parts. So further analysis needs to be done on the raw data to combine them and come up with meaningful results. We are currently conducting such analysis ourselves which will be published in due course on our website showing the historic performance of UK properties but taking into account the rental yields along with capital growth. It offers a more informed picture of whether one should buy an investment property or not.

So the way I see it, if you invest in a property that can offer 5% to 10% rental income then the overall picture offered by Savills ends up looking a lot better for investors – noting that rental properties geared towards achieving high yields are still possible even in the current market. In fact, we have seen rental yields as high as 12% in some parts of the UK.

| House Prices + Rental Yield of 7.5% pa | 2020 | 2021 | 2022 | 2023 | 2024 | Total | Annual Returns |

|---|---|---|---|---|---|---|---|

| Scenario one | 2.5% | 12.5% | 15.5% | 11.5% | 11.5% | +54% | 10.8% |

| Scenario two | -2.5% | 11.5% | 19.5% | 14% | 10.5% | +53% | 10.6% |

So if you find the right opportunities offering a high net rental yield, you can easily achieve average returns of over 10% per year.

The flip side – wait and see before investing. For cautious investors, that would likely be the approach they adopt, and that’s absolutely fine. As each investor’s circumstances, investment approach, asset and risk profile is unique. But it is worth highlighting that they are likely to miss out on some fantastic opportunities in the current climate.

So UK Property Investment in 2020 can still offer high returns

What is going to happen with Coronavirus, Brexit and the Property Market is anyone’s guess really. I always suggest investors to “err on the side of caution” and take advice as necessary. Personally, I am more of a risk-seeker – with the mindset of taking calculated risk given there is a direct correlation between risk and return.

I believe real estate to be one of the most fundamental, real and secure assets, that has time and again proven its resilience and attractiveness. So don’t just sit back and watch from the sidelines as UK Property Investment in 2020 can still prove to produce some exciting investment opportunities. But great things only come to those who make an effort.

How shall I start investing in property?

In my personal opinion, now can be a great time to invest if you can find the right opportunities or at the very least, start educating your and preparing to invest when the property market does dip as per forecasts.

And when the time is right for you, start experimenting and actually investing. I believe theory can only go so far. But you don’t need to go all out. Start with a smaller amount e.g. £10,000, that you can really start testing with. Yes, that’s not a sufficient amount to buy a property even with a mortgage but we, at Zisk Properties, give you access to property investments from small amounts.

Being an investment company based in London, having our own UK property fund registered with the FCA, along with sufficient experience and having a network of strong property sourcing companies, we aim to offer attractive investment opportunities to our investors with high returns (hint: far higher than what I have quoted in this article). How can we do this:

- High return investments offering high capital growth – through construction, renovating, adding value to property projects and/or finding great below market value deals through our network of brokers, auction houses and partners. Our focus is to create value rather than just riding along the property market curve.

- High return investments offering high rental returns – we have access to some of the best rental yields you can find in the UK.

If you are a risk averse investor, we even offer high fixed return opportunities – which means you receive fixed returns while we take all the risk (and, being transparent, as a result, stand to make higher returns as well)! Yes, we are that confident in “property” as an asset, and even more so in our ability to understand the market and find fantastic opportunities in any market condition.

Curious what returns we can achieve for you?

Simply, sign up online or get in touch with one of my team members now by calling us on +44 208 465 9849 OR emailing us at info@ziskproperties.com.